When it comes to tracking the live performance of Ethereum through charts, it's important to have access to reliable and up-to-date information. The following list of articles provides valuable insights and tools to help you stay informed about Ethereum's live chart movements. From understanding technical analysis to interpreting market trends, these resources will aid you in making informed decisions about your investments in Ethereum.

How to Interpret Ethereum Live Charts for Successful Trading

none

Top Tools for Tracking Ethereum Price Movement in Real Time

Ethereum has quickly become one of the most popular cryptocurrencies in the world, making it essential for traders and investors to stay informed about its price movements in real time. Fortunately, there are several top tools available that can help you track Ethereum's price accurately and efficiently.

One such tool is CoinMarketCap, a widely used platform that provides real-time data on the prices of various cryptocurrencies, including Ethereum. By using CoinMarketCap, you can easily monitor Ethereum's price movements, market capitalization, trading volume, and other key metrics all in one place. This tool is essential for anyone looking to stay updated on Ethereum's performance in the ever-changing cryptocurrency market.

Another valuable tool for tracking Ethereum's price movement is TradingView, a powerful charting platform that allows users to analyze price trends, patterns, and indicators in real time. With TradingView, you can create custom charts, set up alerts for price changes, and access a wide range of technical analysis tools to help you make informed trading decisions.

Overall, staying informed about Ethereum's price movement in real time is crucial for traders, investors, and enthusiasts who want to capitalize on the volatile nature of the cryptocurrency market. By utilizing top tools like CoinMarketCap and TradingView, you can stay ahead of the curve and make

The Importance of Using Candlestick Charts for Ethereum Analysis

These charts <a href"recover.php">You forgot your password? provide valuable insights into market trends and help traders make informed decisions about buying and selling.

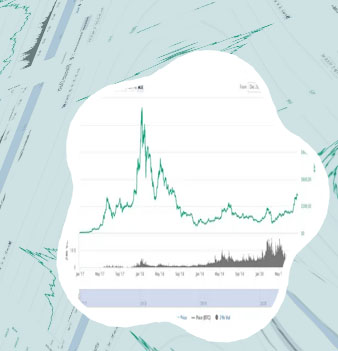

Analyzing Historical Data on Ethereum Live Charts for Future Predictions

Ethereum, one of the leading cryptocurrencies in the market, has been subject to intense scrutiny and analysis by investors and traders alike. One method that has gained popularity is the analysis of historical data on Ethereum live charts to make future predictions. By examining past price movements, trading volumes, and market trends, analysts can gain valuable insights into potential price movements and make informed decisions.

There are several key factors to consider when analyzing historical data on Ethereum live charts for future predictions:

-

Price Patterns: By identifying recurring patterns in price movements, analysts can anticipate potential price trends and make informed trading decisions.

-

Trading Volumes: Monitoring trading volumes can provide valuable insights into market sentiment and potential price movements. High trading volumes often indicate increased market activity and price volatility.

-

Market Trends: Keeping track of market trends, such as regulatory developments, technological advancements, and investor sentiment, can help analysts anticipate potential price movements and make informed decisions.

-

Support and Resistance Levels: Identifying key support and resistance levels on Ethereum live charts can help analysts determine potential entry and exit points for trades.

-

Technical Indicators: Utilizing technical indicators, such as moving averages, RSI, and MACD, can help analysts confirm potential price trends and make more accurate predictions.